Category: Finance

🗞 FI BOOK CLUB 2️⃣

🗞 FI BOOK CLUB NEWS 📚

FI BOOK CLUB

I am planning to read 12 books around financial independence in 2022, 1 per month, and am going to host a book club to discuss the book of the month on the 4th Friday of each month. I am in California, USA, and planning to do this from 7-8:30pm PST. If you can make it, DM me your email address and I’ll add you to the google cal invite! The books I’ve chosen are in the next image. Hope everyone is ready to claim abundance in 2022! 💸

Can I Hit It?

For my 2020 goals – I put something on there I couldn’t completely control. I wanted to hit a specific number on my credit score. If you have ever looked into this topic you know this is mainly in the hands of the 3 major credit score companies, and even they don’t agree. Then there are all the new spinoffs like FICO and Vantage Score, so why would I try to make this a goal?

As my financial IQ has increased, I see ways I could improve this area, even if I didn’t have total control of it. In 2015 I made a commitment to be debt free. In 2018 I discovered the FIRE movement. I started crushing my debts and learning about personal finance. The momentum was building. Why not make this goal? It’s not like anything bad would happen if I didn’t accomplish it. Worst case scenario, it would just plateau or grow more slowly than I’d prefer. No big deal. At least it wouldn’t go down because I was finally making smart financial decisions. No way that could happen with all of the positive forward momentum I had…right?

In December 2019 my credit score had just hit 700. I made a goal to hit 800 by December 2020. It seemed like it was ticking upward pretty quickly in spite of my former delinquent years with my successful course correction. I had all of my payments automated, no more late fees, I was becoming solvent. Let’s do this. I was pumped!

I checked it every month and it increased every month as expected. January 713. March 748. May 764. “Oh!”, I thought, “I’m going to hit this sooner than expected”. June 738. Wait, what? OK. I took out an interest free credit card to transfer the remainder of my car loan balance. Just a snag. We’ll be back in a minute. Yep, back to going up. August 766. October 769. By December it was back down to 762 because I paid of the car loan and the account fell off my history. I also paid off the zero interest credit card that I transferred the balance to. I don’t agree with the math behind these systems because the way it formulates negative points for good behavior like paying off a loan, but whatever. I didn’t hit my 800 but my score went up 62 points in 2020 and that was still fine by me, so I decided to try again for 2021.

Of course now I am starting with 62 more points than the year before with the same goal so I bump it up to 825 for 2021. Seems reasonable, right?

January 789. OH. OK. Nice start. So I get confident and forget to record the next few months. May 753. UGH. What a blow. I bought a new property, and did a cash out refi on my other mortgage. FINE. I decide to ignore it again for a few more months. I’m too busy crushing goals to babysit this thing, and I know it will come eventually. I’m going to break 800.

Once in a while I check in. It’s up. It’s down. Minimal changes are happening in this yoyo period, like 3 or 4 points each time. The annoying part? It’s on that line between good and great or great and excellent. So I have a glimmer of excellent and then it falls back again. You’re excellent! You’re NOT. Don’t look at it. Just put it away and hope for the best.

Finally I gain traction again in September, 763. October 789. “Wow!”, I think, “I may really hit 800 this time!” I look back on my notes. Right. I had 789 in January when I started so I’m just back at square one 10 months later. OK. Come on home stretch, give it to me this time. It’s just 11 little points. Please!

Then I look at my New Years Goals. Oh Yea. I upped the anti to 825. Well. Hmm. I have no idea if I’ll hit 800 or 825 but here’s to mega manifesting. Can you please send some good juju my way?? Girl just wants to get in that 8xx zone already!

There are 2 more updates before the end of the year. Do you think I’ll hit 800? 825? Somewhere in between or not even close? Would love to hear your bets!

ps Prior to taking control of my finances circa 2015, I had a very low credit score (in the 300s for a while), delinquent loans (went through a loan rehabilitation program), and delinquent credit cards (creditors called me on the reg). If you think this isn’t possible, I’m here to tell you it can be done. Keep reading. Keep learning. Keep stashing. You got this!

Want more ideas about New Years Resolutions? Check out: New Years Manifestations

The Late Bloomers FIRE Starter Guide

I was a late starter and have made a complete 180 in the past few years after I had an aha moment. I was struggling and feeling my age and health issues creeping in and started to not be able to keep up.

First I read Rich Dad Poor Dad to get some financial IQ and found it fascinating because while I expected a boring finance 101, it is more a narrative about money mindset and what we initially learn and build our actions around depending on the wealth we are or are not born into.

Richest Man In Babylon is another good read and also available as audiobook, free on YouTube.

Soon after I read these I discovered the FIRE Movement which largely focuses on Index funds and/or real estate, typically. Vanguard is actually member owned so their rates are lowest, and Jack Bogle (vanguard founder and philanthropist) was the one to create the Index fund solution, which holds a broad range of companies. This is best optimized through IRA, 401K, and HSA since they are tax advantaged accounts and lower your tax burden. The trick is to optimize the accounts through indexing after the money is initially added to them. I learned late that if you work for yourself you can contribute to 401K as both the employee and the company owner. When I was freelancing I always thought you needed a jobby-job for 401K, but nope.

Using mint.com to get real with my spending and expenses was unexpectedly eye opening. I thought I was frugal but I found lots of holes in my spending, so I developed a budget which in itself was liberating, and allowed me to increase my savings rate, even when I thought I had no room to budge. Next I started using Acorns to round up my pennies every time I swiped for purchases. This was extremely helpful when I didn’t have anything to spare for savings. Seeing this account grow was really motivating and eventually I was able to increase it to save $20 / month then $100 etc. Combining this with checking my mint account to keep an eye on mindless spending (even if it was cheap stuff) really helped me re-prioritize.

What I like about the FIRE movement is you don’t have to pay an advisor who typically skims the top and takes so much more than you realize, all for something you can do yourself with some self directed edu. Once you learn the basics it’s not as daunting as it seems and it’s pretty straight forward. If I can learn it, anyone can, as cliche as that phrase is, it’s genuinely valid. I had no clue, came from extreme poverty and was placed in the system at a young age. This journey has been very enlightening. It’s surprisingly accessible to all walks of life, but it is definitely not mainstream knowledge.

Some really helpful podcasts, websites, and IG accounts that have helped me immensely are below. All are BIPOC and/or Women Owned.

Afford Anything

HerFirst100K + Financial Feminist

Millennial Revolution (insightful at any age)

A Purple Life

Our Rich Journey

Rich + Regular

The next step in my personal journey is to learn more about sustainable investing. Ellevest is created by women for women and has tons of free resources on their IG FEED, and the ETF “VOTE” is supposedly driving activism through their investment platform.

Even before getting into investments, HYSA, High Yield Savings Account – is a better way to save. Building a 3-6 month emergency fund is an important step to protect your future and keeping it in HYSA will grow your stash. Rates were much higher pre-pandemic and are taking their sweet time getting back up to those rates. but currently CIT, Amplify, and Chime are doing well. You can get an HYSA at many credit unions as well. Here’s Nerdwallet’s Report for 2021 HYSA.

Nerdwallet is a good way to stay informed, and Investopedia is a great learning tool as well.

A few notable Nerdwallet articles:

Learn how to invest in Black-owned businesses and green companies.

LGBTQ Financial Planning Guide.

I know this is a lot of info for a primer but it’s worth the rabbit hole to be able to course correct and give yourself a real safety net. I hated money my whole life until my body started to break down. At the end of the day I have come to believe that money is a tool, or an energy. It isn’t inherently evil or inherently good. I got tired of not having enough to share and felt like I was only hurting myself in the end.

While the system is undoubtedly fckd, there are strategies that allow people to ethically help themselves and help each other. I try to focus on using monetary energy for good, growth, charity, and community.

Everyone deserves prosperity.

From Bad Credit to Financial Feminist

I was turned down for a mortgage for 3 years straight before I bought my first property.

I kept asking questions. What does one need to be approved for a home loan? What do I need to change to be approved? How can I get there? What can I realistically do to achieve this? Can I actually even do this?

I grew up dirt poor and had no role models or financial IQ. All I ever knew was survival mode. I thought I was really financially responsible because I always paid my rent and utilities on time, a result of being evicted and homeless throughout my childhood. I always kept that money saved and never dipped below that balance. However, I was completely financially ignorant. I’d like to say that the worst of it was that I carried large credit card balances but that isn’t even the tip of the iceberg.

I went for years without even paying a DIME to my school loans…and it was intentional. I was mad. I took out so much money for school and living expenses to put myself through college, but I couldn’t even get a job in my industry, and I was at the top of my class. I graduated not long after 9/11 so the economy was junk, and then I gave myself a bigger challenge by moving to Austin which was still a pretty low key town at the time, especially coming from a big city like Philadelphia. So I couldn’t find work, went back to waitressing, and stayed broke. “Why should I pay these loans that did nothing for me? Credit? I don’t need credit because I’m anti-capitalist and anti-consumer so who cares about credit?!”

Very idealistic and naive, yes oh yes, beautiful youth. I’m still anti-consumer but as an entrepreneur minded person I can’t quite call myself anti-capitalist. Growing up in desperate poverty I had always followed the implicit tenants of money is evil and convenience is the enemy, but in truth, money is a tool and it’s just in how you use. It is also an energy, so it doesn’t have a singular essence. Again, it’s how you use it. You can assign it to good or evil. You pick. Further, that is banter created by the patriarch to disempower the masses.

So, how did I turn this ship around? First and foremost, I gave myself an education. I was already in my 30s when I started to hear myself say, “I’m so sick of being broke and constantly struggling financially. I’m smart and able but I literally can’t work any harder to get ahead. There has to be another way.”

It was true, I was working my tush off. I would work months on end on shows that would load in at 6am, work all day setting everything up, then breaking it down after the show and getting to bed at 2 or 3am. I would do it again the next day, and the next, sometimes with no days off for weeks or months, and then sleep for a week. How could I break the negative financial cycle and get some work life balance? What was I doing wrong? The answer, in short, was everything.

I didn’t know how to save. I didn’t know how to invest. I didn’t know how to manage debt. I didn’t know how to negotiate. As far as the banks were concerned, I was crap on paper. So I began by cleaning up my credit score which started in the 300s. I got into a credit rehab program with the school loans that I had neglected. Trust me, that was painful. If you get only one takeaway from this blog, let it be to take the initiative to thoroughly educate yourself about compound interest. It can make you rich or it can ruin your life. In my case, it shoved me down a large, deep, dark financial hole, and it was very hard to climb out.

I made it my mission to find ways to pay down my debt. The interest that had accrued in the 10 years I let my school loans simmer, made what I owed nearly twice as much as what I had started with. The only difference about my anger towards this debt was that it had become self directed. Now I wanted to have a good credit score so I could have access to buying a home, or access to capital to potentially start a business, and I knew that the reason I didn’t was entirely my own fault. What I learned was that I had written myself out of options and had to start from scratch as a middle aged woman to get myself on track.

From then on out it was just consistent laser focus on #GOALS. I stopped eating out so much, and drinking as much, stopped shopping mindlessly, and started to learn how to create a functional budget. I learned (and was shocked) about my actual spending habits by building and studying my budgets in MINT. It took a couple of years to really get it right through alot of trial and error. Not gonna lie, it was a big learning curve. When you think you’re responsible because you pay your rent on time and you don’t buy expensive things, and then you start looking at the actual data and categorization over time which causes your eyes to bulge and your mouth yells, ” I spent how much on what?! HOW!?” To my surprise I found out I wasn’t frugal like I thought I was, I was just cheap. Chump change adds up quick when you start collating. Once I was finally able to lower my spending on useless CRAP and pay off my debt with the #debtavalanche method, I was eventually able to invest.

I started with ACORNS which was perfect for someone in my shoes because I had VERY little to invest, not nearly enough to meet the minimum requirements of investment platforms like Vanguard, Schwab, or TD Ameritrade. I also still had a TON to learn about investing as I had only gotten as far as teaching myself about crushing debt and following a budget. I was still in the theory stage of investing and not really clear how to get into that. In fact before I even invested formally, I let Acorns take round ups from my daily purchase swipes. I am not exaggerating when I say I did not notice this at all. It made zero impact on how much money was in my bank account. It was so seemingly miniscule that I didn’t even look at my Acorns account for the first 6 months. When I did I was amazed to see that I had saved several hundred dollars. This feature is brilliant and was definitely a turning point for my progress. I kept taking one baby step after another. This is attainable. It takes educating yourself, but dang that internet sure is generous with sharing information.

Women were not legally allowed to have a bank account until the 1960s. They didn’t get the right to have a credit card in their own name until 1974. That is only one year before I was born. And that was white women. Black Women and all People of Color didn’t have it handed over as easily, just look at what happened to Black Wall Street in Tulsa, OK. Still today, systemic racism is so bred into our institutions that black homeowners have to have a white person stand-in and pretend they are the owner just to have their home appraised for what is actually worth. The disparities have been 10s of thousands and even millions of dollars. So, if you want to call someone a sellout for wanting to achieve financial control for themselves, I’m here to tell you that no one is getting one over on “the man” by staying broke and hating money. That sentiment is just part of the plot.

I decided I wanted to have enough to share because being opinionated and preaching to the choir wasn’t really gaining traction. I started to imagine what my childhood would have been like if I had been born into financial security, not rich per se, just secure. Where would I be now? Would I have followed my ambitions with direction and certainty instead of spinning my wheels like I had for so long? I went into deep contemplation over several years to battle some very deep seeded ideologies I had built around money. Along that journey I also had to learn that you must fill your own cup to be able to give fully. So now I am working on setting myself up for my future while simultaneously increasing donations to organizations that make a real difference with ACLU and NAACP, as well as contributions to IndieGoGo / GoFundMe campaigns for as many people and causes as I can. I also love supporting local businesses that pay a living wage and use sustainable products. That kind of money isn’t evil at all. It is a force for good.

10 years ago I would never have believed how quickly you can turn your finances around with a few simple tweaks and awareness, or that I would even be debt free in my lifetime. I hadn’t even started thinking about that 10 years ago. It has only been 5 years since I purchased my first property and I still had quite a hill of debt when I did so. Now I am consumer debt free, own 2 properties, have 2 retirement funds growing (401K, IRA), and a 6 month emergency fund. More importantly, I know I’m on a secure path, and my morals are very much still in tact, enhanced actually. I want you to know there is hope. There are methods. There are programs. It is never too late to start. I believe in you.

*I am not a financial advisor. This is my personal story. I believe in hope through education and relentless determination.

Turns Out…

Turns out I have a crush on disruptive #fintech. So I purchased my first art investment through #Masterworks.

My first investment is in Pumpkin, 1990 by Yayoi Kusama. It was very exciting to be able to play a part in uplifting a female artist, and an asian artist. White men have dominated art history and women often had to hide under a male sounding name in the creative arts or be written out entirely. As the Guardian puts it:

“One of the startling things … is the way that Kusama seemed to be written out of pop art history. There was a point in the 60s when she shared almost equal billing – and notoriety – with the likes of Andy Warhol and Claes Oldenburg. Part of this eclipse seems to have been by design – Kusama has long claimed that her original ideas were appropriated by the Wasp-ish men around her and passed off as their own.1

Yayoi’s personal history is fascinating and her renaissance coming full circle in her 80s is exciting to watch.

Also, Masterworks is disrupting the concept that Blue Chip Art is for the ultra wealthy alone, to be hidden in private auctions in some kind of circle jerk. Look, I’m not going to say I understand why one piece sells for $7 million and another is $25 at a coffee shop, but I do like the idea of expanded accessibility. This is essentially a crowdfunding platform that facilitates investments with fractional shares via a blockchain solution.

According to The Wall Street Journal, in 2018, artwork returned an average of 10.6% return versus a 4.38% loss in the S&P 500.2 So that’s not nothing. Now I am a FIRE gal and I love the security of #indexfunds so don’t worry I haven’t fully strayed, but putting a chunk into @masterworks.io is just another way to diversify as far as I’m concerned. Frankly I threw money away on much greater risks with no potential returns when I was young and hungry, so don’t @ me. This is interesting and I want to see where it goes.

How about you? Have you tried something new and edgy lately?

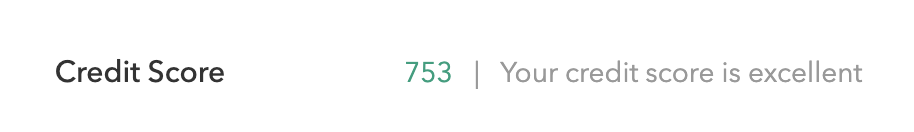

Credit Score Goals

As a goal oriented person, I always love setting New Year Resolutions, or New Year Goals, every year. I know alot of people that are adamantly against this. People say, “why bother if you’re just going to fail.” I see their point (kinda), but I have always followed the ideology of it’s not how many times you fall, it’s how many times you get back up. Fear of failure isn’t an option, but what’s more, it gives me something to work towards, as well as an opportunity to set an intention.

One of my New Year Goals for 2020 was to raise my credit score to 800. This one was tricky because I knew so much of this achievement would be out of my hands. First of all, there are 3 credit bureaus calling the shots and they don’t even agree with each other. Second, it’s a mystery to me how it even works. There is a lot of bait involved in this credit business. For example, my credit score would slowly tick up as I paid off debts and kept lower balances, but when I had a car emergency and had to take out a car loan, I was stunned to see that my credit score shot up several points after taking on this new large debt. Why? I didn’t feel I should be rewarded for that, but it’s some weird formula to encourage you to keep spending, and most people spend beyond their means when it comes to credit. Third, it took me years to get to 700 alone. I got my first credit card in college, along with the school loans, and promptly threw my score in the gutter for over a decade at just over 300 points. To say I was irresponsible with my credit is an understatement. I came from extreme poverty with a subzero financial IQ before I turned this ship around.

So, as you can see in the image, I did not achieve my goal of 800 points, BUT I did gain 89 points from the year before. In December 2019 before I made this goal I had just hit 700 even. Is this a failure? NOPE. This goal gave me mindfulness. Every month I recorded my updated score. I was encouraged because I was actively paying down debt, learning to live within a budget, and watching the score go up. I’ve been working on my budget for years but it takes a long time to master! Having this goal made me focused and vigilant to get the best results possible by persevering and course correcting as needed. I’d call this a win.

A credit score of 800 or higher is considered perfect and I was able to get so close that now I can definitely have it as an achievable goal for 2021. Even though it will take me a little longer to get there, I’m stoked to have stayed the course and to keep reaching higher.

What financial goals are you setting for yourself in 2021? Remember, it’s never too late to start anew. I re-evaluate my New Year Resolutions every quarter to make sure I’m on track and make updates if anything has shifted. It’s not written in stone, it’s your life novel to write and edit as you deem fit. You can do anything you set your mind to. I believe in you!

If you can believe it, you can achieve it.

~ Napoleon Hill